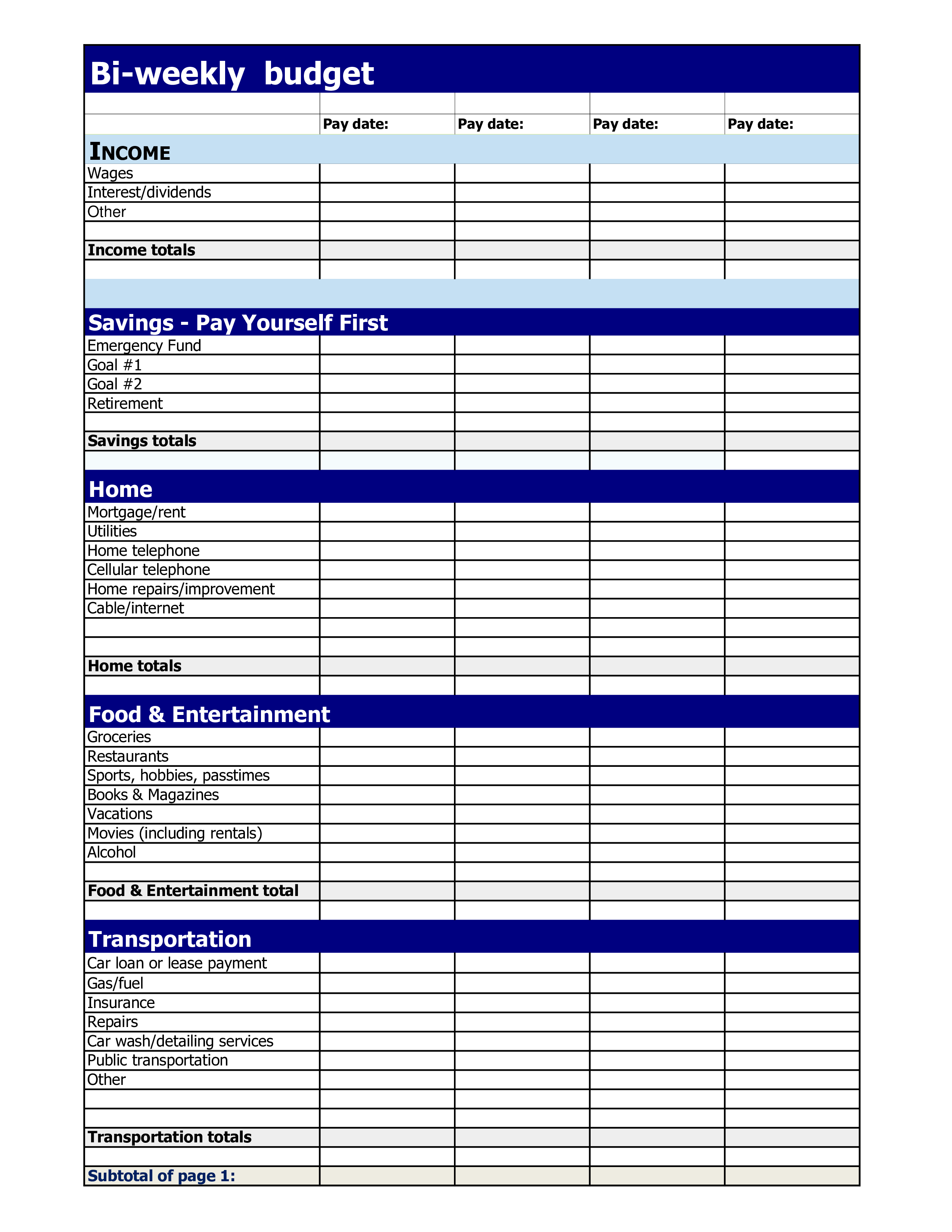

That will be a great conversation in and of itself-you figure out what’s actually important to you about celebrating the season. Make a plan for that money, based on your priorities for the holiday (do you need airfare this year? Do you want to host the Christmas dinner?).This gives you a pretty accurate idea of how much you’ll need in this category group. Check how much money was spent on the previous holiday season (Heyo, YNAB reports!).It doesn’t overflow into the rest of our budget. If we want more money for fun activities, where are we willing to spend less? Decorations? Groceries? Now any Christmas overspending has to be covered by another Christmas category. Is our Christmas budget plan perfect? No way-and we didn’t expect it to be.

#PRINTABLE BUDGET PLANNER FULL#

This gives us a full 12 months to save for next Christmas and drastically lowers the amount we set aside each month.

This feeling is here to stay! When January rolls around, we start fresh on our Turbo Christmas category group. It was the greatest gift of all, actually. We did it! We actually stuck to a holiday budget! We finally felt in control of our holiday spending. The good good news: No limping along in the months to follow. When we first started, it was a stretch to get the categories funded in time for Christmas because we started midyear, but every little bit of holiday savings helped.

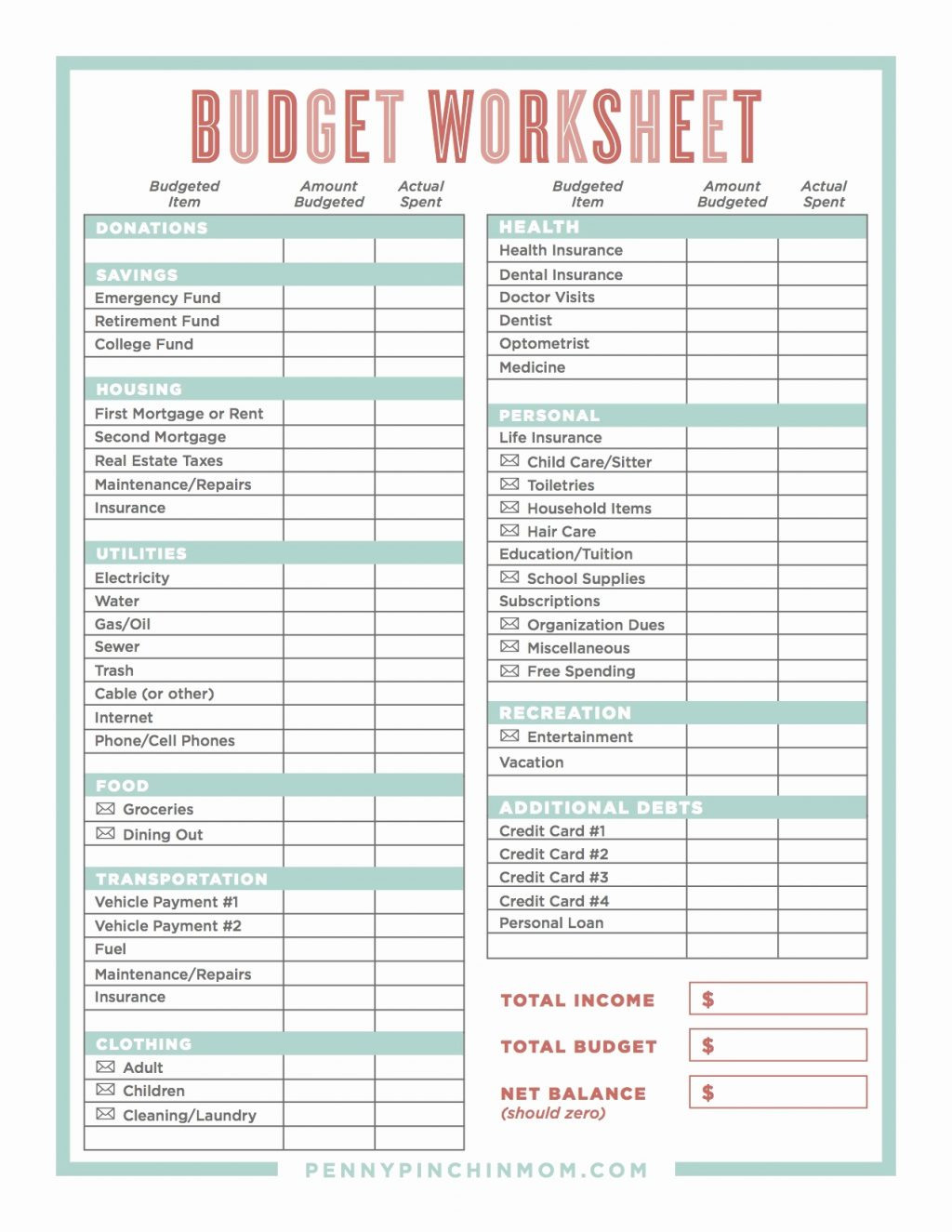

It takes up quite a bit of real estate, so I keep it closed and at the bottom of my budget for most of the year. Here’s what it looked like: Creating detailed categories for our holiday budget helped us be more realistic about holiday spending. There was a category to help us save money for every person we bought holiday gifts for (including each other), feeding a crowd of family members, holiday decorations, wrapping paper, fun activities, and even a category for shipping costs to mail packages to loved ones who weren’t with us in person. The next year, I created a Turbo Christmas category group. We could do better: Time to drill down into more detail. The bad news: We were still limping along months after Christmas was over because we had moved money out of other non-monthly spending categories like Medical Expenses, Auto Maintenance, or Clothing. The good news: When the new year rolled around, there was no debt waiting for us. There was a lot of moving money around between categories to cover Christmas expenses. That year, our Christmas spending was way more under control, but we completely underestimated what Christmas actually cost us. I was banking on Rule Two to rescue us from Christmas debt. I was following Rule 2: Embrace Your True Expenses, and Christmas fit the bill perfectly as a non-monthly expense. Each month we would put a manageable amount of money toward our holiday expenses. When I set up my YNAB budget, I made sure there was a Christmas category right away. So when we started using YNAB as a budgeting app, I wanted to stop this annual holiday shopping debt once and for all. My holiday spending would then go on to impact every part of my life for the next 12 months. I would charge my way through the season and live with the debt afterwards. While I loved Christmas, the credit card companies loved me. But I haven’t always been the best about sticking to a holiday budget. I love planning it, I love doing it, I love it all. The tree, decorations, stockings, presents, carols, turkey, and cranberry sauce-the whole holiday season, really.

0 kommentar(er)

0 kommentar(er)